Real estate investment has always been an attractive option for individuals and businesses looking to diversify their portfolios and generate long-term wealth. In recent years, Bangladesh has emerged as a promising market for real estate investment, offering numerous opportunities for investors.

However, like any investment, real estate in Bangladesh comes with its own set of opportunities and challenges. In this blog post, we will explore the current state of the real estate market in Bangladesh, the opportunities it presents, and the challenges that investors may encounter.

Opportunities in the Bangladeshi Real Estate Market

-

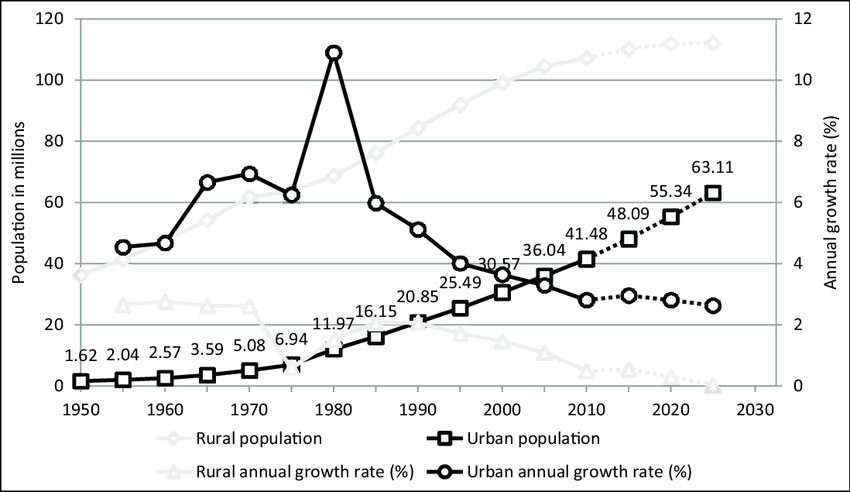

Rapid Urbanization:

Source: Researchgate

Bangladesh is experiencing rapid urbanization, with a growing population and increasing demand for housing and commercial spaces. This creates a significant opportunity for real estate investors to meet the demand for residential apartments, office spaces, and retail outlets.

-

Economic Growth:

Source: Internet

Bangladesh has been experiencing steady economic growth in recent years, which has led to an expanding middle class and increased purchasing power. This rising affluence has created a demand for high-quality residential properties, including luxury apartments and gated communities.

-

Government Initiatives:

The Bangladeshi government has introduced various initiatives to attract local and foreign investment in the real estate sector. These include tax incentives, relaxed regulations, and the establishment of economic zones, which provide opportunities for developers and investors to capitalize on.

-

Infrastructure Development:

Source: The Daily Star

The government has been investing heavily in infrastructure development, including transportation networks, power supply, and utilities. These improvements enhance the overall desirability of real estate investments, particularly in areas with improved connectivity and amenities.

-

Low Property Prices:

Compared to many other countries in the region, property prices in Bangladesh are relatively low. This affordability factor presents an opportunity for investors to enter the market at a lower cost and potentially enjoy significant returns as property values appreciate over time.

Challenges in the Bangladeshi Real Estate Market

-

Regulatory Environment:

The regulatory environment in Bangladesh can be complex and bureaucratic, making it challenging for investors to navigate the legal processes involved in acquiring and developing real estate. It is important for investors to seek professional legal advice to ensure compliance with all regulations and to mitigate potential risks.

-

Infrastructure Limitations:

While there have been improvements in infrastructure development, certain areas in Bangladesh still face challenges such as inadequate transportation systems, insufficient utilities, and limited access to basic amenities. Investors need to carefully evaluate the infrastructure of the location they are considering for investment to ensure long-term viability.

-

Land Acquisition:

Land acquisition can be a cumbersome process in Bangladesh, as disputes over land ownership and documentation can arise. Conducting thorough due diligence is essential to avoid legal complications and potential conflicts in the future.

-

Market Volatility:

Source: Internet

Like any real estate market, the Bangladeshi market is subject to fluctuations in property prices and demand. Economic and political factors can impact market stability and affect investor returns. It is crucial for investors to conduct comprehensive market research and analysis to make informed investment decisions.

-

Financing Options:

Limited access to financing options can be a challenge for real estate investors in Bangladesh. While local banks and financial institutions provide loans, interest rates and terms may not always be favorable. Exploring alternative financing options or partnering with local developers can help mitigate this challenge.

Conclusion

Investing in real estate in Bangladesh presents promising opportunities for investors, driven by factors such as rapid urbanization, economic growth, government initiatives, infrastructure development, and affordable property prices.

However, it is important to be aware of the challenges that come with investing in this market, including regulatory complexities, infrastructure limitations, land acquisition issues, market volatility, and financing constraints.

By conducting thorough due diligence, seeking professional advice, and staying informed about market trends, investors can navigate these challenges and potentially reap the rewards of their real estate investments in Bangladesh.